Investor Returns and Implied Valuation Model

₹ 0.00

The model is for Founders looking to assess the expected Investor returns when seeking funding and accordingly position their pitch

Works with

Model Highlights

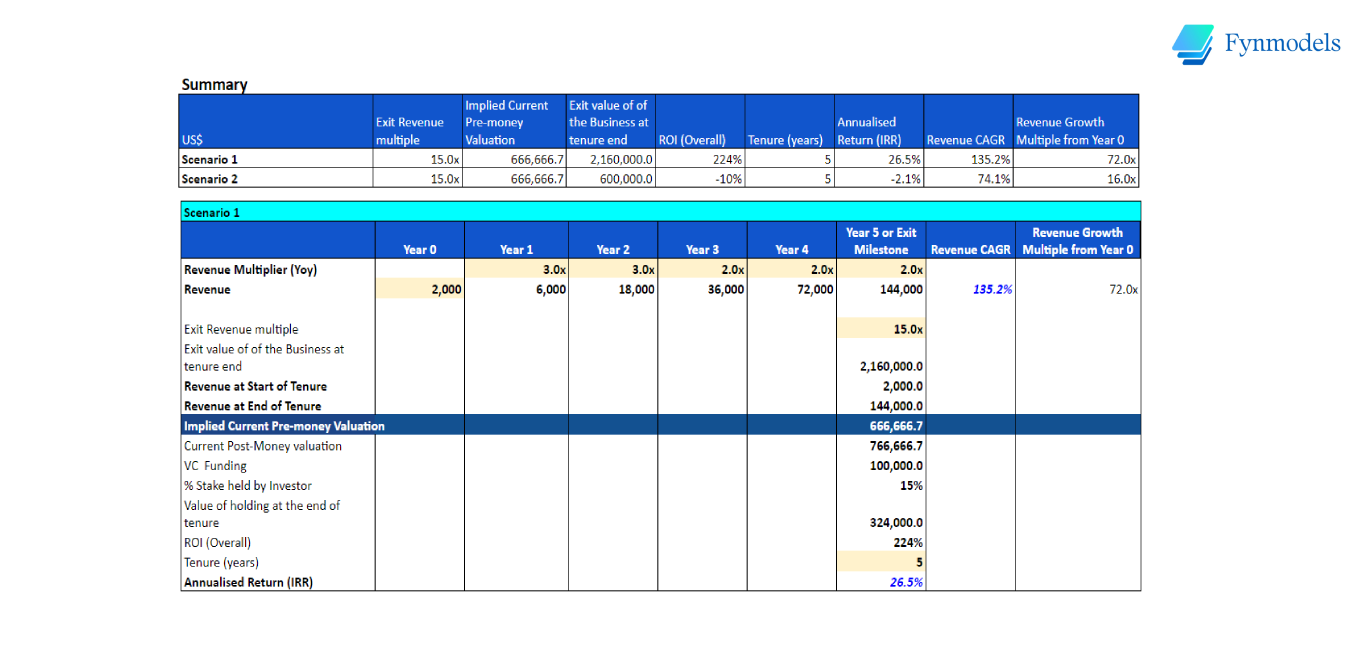

This model is an easy and customizable tool for equity investors to calculate the expected Investor Returns and therefore the implied current Pre-Money Valuation. The key drivers of the model are expected revenue multiple growth and percentage stake acquired by the investor. Using this, an Exit Value is computed; which is further used to calculate an annualized return percentage. The model is most beneficial for startups and early-stage businesses since it shows the attractiveness of investing in your company for any venture capitalist. If the calculated return percentage is on par with investor expectations, it can be concluded that the investment will be appealing.

What is Inside the Model

Quickly build a financial model / business plan by using our pre-built models with commonly used business drivers and Key Performance Indicator (KPI) Dashboard

Understand Investor Expectations

The model helps to calculate the IRR (Internal Rate of Return) for Investors. This is an indispensable analysis since it considers variables like tenure of investment, percentage stake acquired, amount invested and so on to arrive at an estimate of the expected return from investment. Founders would be able to put themselves in the shoes of Investors and understand the returns generated by their business for Investors and accordingly position their pitch.

Additionally, the model facilitates scenario-wise analysis i.e. it allows investors to adjust their growth expectation of your business; the IRR will also adjust accordingly.

Assists Founder's Decision- making

For Founders of startups and early-stage businesses, the model serves as a guiding tool prior to decision making w.r.t. Equity dilution. Should you, as a Founder, be aware of the Venture Capitalist's IRR expectation, you could better finetune the input variables. Per the norm, most Venture Capitalists expect an IRR anywhere between 20% to 45%. The IRR alone, is not always enough to sway your investors though.

The Fynmodels portal offers Core and Category Models to help you better streamline your financial progress. For further assistance, reach out to us through the Fynmodels portal!

Analyze Scenarios for Guided Decision-making

The model facilitates scenario-wise decision making. Investors and Founders can adjust the model as per their expectation of growth. The ultimate goal is to maximise value creation for Investors and the model allows you to do this by allowing you to compare between various positive and negative outcomes possible.

Investors can rank these comparisons to determine whether investing in your company would be worth their money. For Founders and Business Owners, on the other hand, the model is crucial when approaching investors for fundraising.

How to use Fynmodels

Fynmodels gives you the power to forecast your company’s topline and bottomline. Gain clarity on expected profitability, use it to create dashboards, identify key drivers of profit, establish annual budgets forecast forecasts and more!. Take a look at the quick introductory video on how you can save time and get to actions faster!

Frequently Asked Questions

If you are looking for more answers on how you can use Fynmodels portal and the models, please read below.

First add the Standard Model to your cart and then browse through the Category models listed in Products section. After purchase, once you add the Category model Sheet to Standard Model, you are good to build a Financial Model for your business.

Go to the Product menu and look for Financial models listed against your required Category. The Product page will give details about what the Category model comprises including a gist of the Revenue and Cost drivers, as well as key Category metrics and Dashboard. The Category model can be upgraded by purchasing Standard Model that includes Pre-built structure of financial statements and Supporting Schedules. Then you simply link the revenue and cost driver numbers into the Standard Model.

Upon receiving the download link, you will be prompted to save a MS-Excel version of the Model. The model comprises an Instructions Sheet which would be self-explanatory and also explaining the flow of data from input to data visualization. A Category Business metrics Sheet and Dashboard are provided which automatically responds to Model Inputs.

You need to link the Revenue and Cost of Sales/ Cost of Service summary table from Category Model into Profit and Lost statement of Standard Model. Follow the Comments within the Sheets to do this.

We recommend using MS-Excel.

It usually takes less than an hour to go through all of the sheets, and once you have the basic information, it takes much less time to adjust the inputs to create a set of forecasts that makes sense for your business. In Category Models, generally, growth rates corresponding to different Revenue and Cost of Sales/ Service drivers need to be input by the User. In some instances, Gross margin percentages might need to be input. Once all necessary inputs are made, the Model responds to the inputs and reflects in the KPI Dashboards.

Fynmodels has tested for model sanctity in the form that is offered to you. Depending on your skills in financial modeling, you are free to customize them yourself. However, impact to Standard and Category Models due to such edits will rest with the user and not Fynmodels.

If and when the Models require any fundamental change, we will be incorporating updates to the model. You will then be notified by email to download and use latest version free of charge.

The model is a simple Do-it-Yourself model. It is designed in such a way that anyone can drive it based on detailed instructions provided by us. If you require Modeling-as-a-Service (customization), we are happy to engage with you on a Project-basis and help you design the model accordingly.

Yes, we create custom models. Click on 'Contact us' for us to reach out to you.

Yes. On a case-to-case basis we offer Customization of existing models. Please contact us for more information.

Not at this moment. However, we do have plans to do so and once decide to initiate such workshops, you will be notified.

Sorry. There are no refunds.

Yes. We use Payment gateways that are secure. Read our Privacy Policies and Terms and Conditions for more details.