DCF Valuation Model

₹ 0.00

Discounted Cashflow (DCF) Valuation Model is for business owners dependent on cashflow to drive their valuation.

Works with

Model Highlights

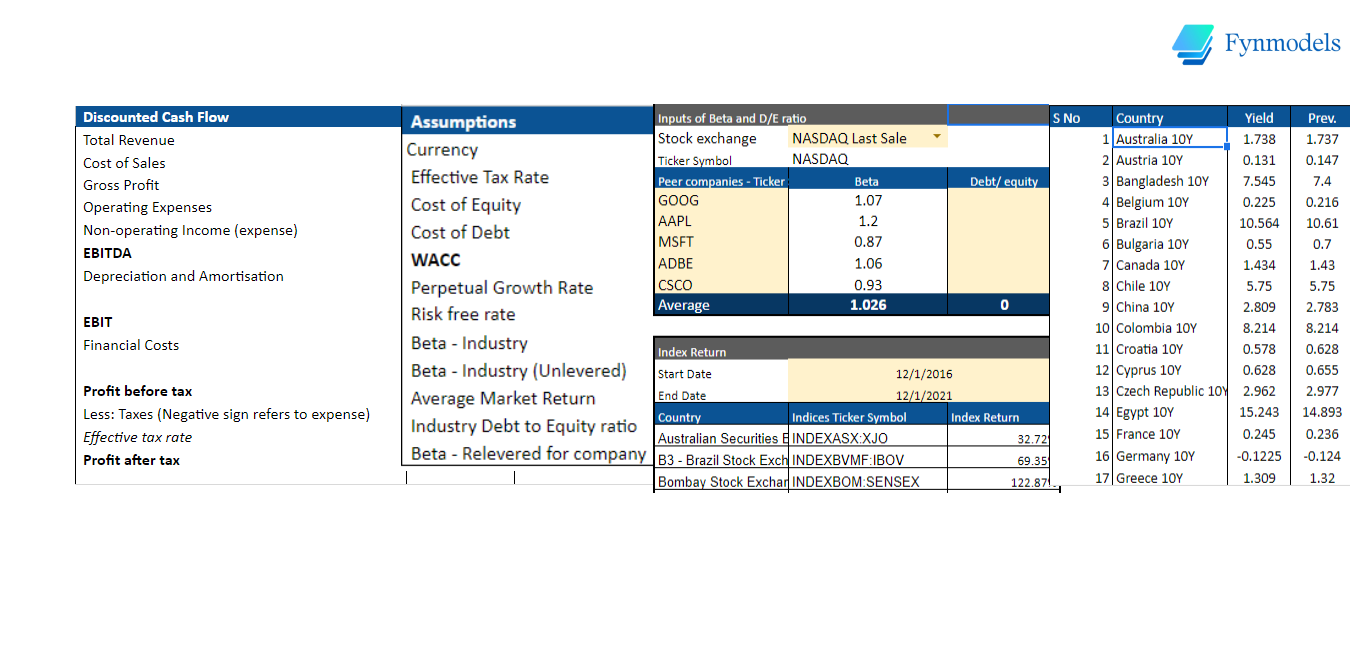

The DCF (Discounted Cash Flow) Valuation Model is an easy to use tool which has been built for a five year period. In a sentence, it is an analysis method used to estimate the future cash flow from a potential investment which is then discounted to the present value. It is especially useful for businesses dependent on cash-flow for valuation and is useful when approaching investors for funding. The model is based on certain assumptions which can be altered to better suit your business.

What is Inside the Model

Quickly build a financial model / business plan by using our pre-built models with commonly used business drivers and Key Performance Indicator (KPI) Dashboard

Understand your Company’s Intrinsic Value

The DCF Valuation model comes closest to estimating your company’s intrinsic value. Since this is a cash-flow based model which considers the impact of working capital and capital expenditure, it is an effective measure of estimating the quantity of money generated year on year.

Once the principles of discounting (inverse of compounding) are applied, we can get to the current intrinsic value of the business’s future cashflow generation abilities. One of the critical assumptions of the model is that the ‘Terminal Value’ is a variable which can effectively capture value-generation in your business on a going concern basis. This variable, however, is dependent on various assumptions and it is key to get these right.

Know the fundamental drivers of your business

For businesses considering different avenues for investment, the model is useful since it serves as a method of comparison based on future returns.The model considers variables such as cost of equity, growth rate, weighted average cost of capital (WACC) and so on, which gives you a clearer view on the fundamental drivers of your business. The model is heavily reliant on assumptions so great care must be taken while determining these.

Should you require assistance with this, our Modelling Assistance services on the Fynmodels portal, are just one click away!

See your Company from the Investor’s Perspective

From the investor’s perspective, a potential investment is ‘worth-it’ if its DCF is higher than the initial cost. As previously mentioned, this is particularly useful for businesses that are primarily dependent on cash flow generation abilities for valuation. Much of the early stage technology companies are primarily valued based on Revenue multiples which is where a Peer Transaction or Market Multiple based valuation is most relevant.

You can tweak the input drivers to do a scenario-wise analysis i.e. investors can look at their expected returns across a whole host of situations. To put it simply, the analysis acts as a comprehensive study of a company’s intrinsic value and whether investing in the company today will generate good returns in the future.

How to use Fynmodels

Fynmodels gives you the power to forecast your company’s topline and bottomline. Gain clarity on expected profitability, use it to create dashboards, identify key drivers of profit, establish annual budgets forecast forecasts and more!. Take a look at the quick introductory video on how you can save time and get to actions faster!

Frequently Asked Questions

If you are looking for more answers on how you can use Fynmodels portal and the models, please read below.

First add the Standard Model to your cart and then browse through the Category models listed in Products section. After purchase, once you add the Category model Sheet to Standard Model, you are good to build a Financial Model for your business.

Go to the Product menu and look for Financial models listed against your required Category. The Product page will give details about what the Category model comprises including a gist of the Revenue and Cost drivers, as well as key Category metrics and Dashboard. The Category model can be upgraded by purchasing Standard Model that includes Pre-built structure of financial statements and Supporting Schedules. Then you simply link the revenue and cost driver numbers into the Standard Model.

Upon receiving the download link, you will be prompted to save a MS-Excel version of the Model. The model comprises an Instructions Sheet which would be self-explanatory and also explaining the flow of data from input to data visualization. A Category Business metrics Sheet and Dashboard are provided which automatically responds to Model Inputs.

You need to link the Revenue and Cost of Sales/ Cost of Service summary table from Category Model into Profit and Lost statement of Standard Model. Follow the Comments within the Sheets to do this.

We recommend using MS-Excel.

It usually takes less than an hour to go through all of the sheets, and once you have the basic information, it takes much less time to adjust the inputs to create a set of forecasts that makes sense for your business. In Category Models, generally, growth rates corresponding to different Revenue and Cost of Sales/ Service drivers need to be input by the User. In some instances, Gross margin percentages might need to be input. Once all necessary inputs are made, the Model responds to the inputs and reflects in the KPI Dashboards.

Fynmodels has tested for model sanctity in the form that is offered to you. Depending on your skills in financial modeling, you are free to customize them yourself. However, impact to Standard and Category Models due to such edits will rest with the user and not Fynmodels.

If and when the Models require any fundamental change, we will be incorporating updates to the model. You will then be notified by email to download and use latest version free of charge.

The model is a simple Do-it-Yourself model. It is designed in such a way that anyone can drive it based on detailed instructions provided by us. If you require Modeling-as-a-Service (customization), we are happy to engage with you on a Project-basis and help you design the model accordingly.

Yes, we create custom models. Click on 'Contact us' for us to reach out to you.

Yes. On a case-to-case basis we offer Customization of existing models. Please contact us for more information.

Not at this moment. However, we do have plans to do so and once decide to initiate such workshops, you will be notified.

Sorry. There are no refunds.

Yes. We use Payment gateways that are secure. Read our Privacy Policies and Terms and Conditions for more details.