Startup Model

₹ 0.00

Startup Financial Model is for Startup Founders looking for a top-down approach to building out their financial forecasts for a five-year period, with annual projections. If you are looking to build a business plan rapidly using linear growth rates or take time and use year-on-year differential growth rates, then this is the right model for you.

Works with

Model Highlights

The start-up model is grounded in a specific product or service i.e. it takes a bottom-up approach to forecasting. This model might be ideal if your business experiences great seasonality throughout the year. For start-ups, this model can assist with making astute budgeting and hiring decisions. The model’s advantages are that it is often considered more realistic, it offers better unit-level forecasting and greater opportunities of employee involvement. This model is highly data-driven and can easily meet your Operational Financial Planning and Analysis needs. It has been built for a five-year period with annual forecasts.

Like all models in our product catalog, this one too is completely editable. Furthermore, it can easily be combined with your own models. If you don’t have one in place yet, head over to our product offerings and choose one of our Category models. The standard model, when combined with our category model (or your own business model), will provide a microscopic view into your business. By making use of ‘Connector’ sheets in the Startup model, you can link your already forecasted monthly revenue and cost of sales numbers and the model will respond and offer you with a full-fledged cashflow and balance sheet forecasting. Decision-making will have never been as hassle-free or convenient!

What is Inside the Model

Quickly build a financial model / business plan by using our pre-built models with commonly used business drivers and Key Performance Indicator (KPI) Dashboard

Forecast your Revenue Precisely

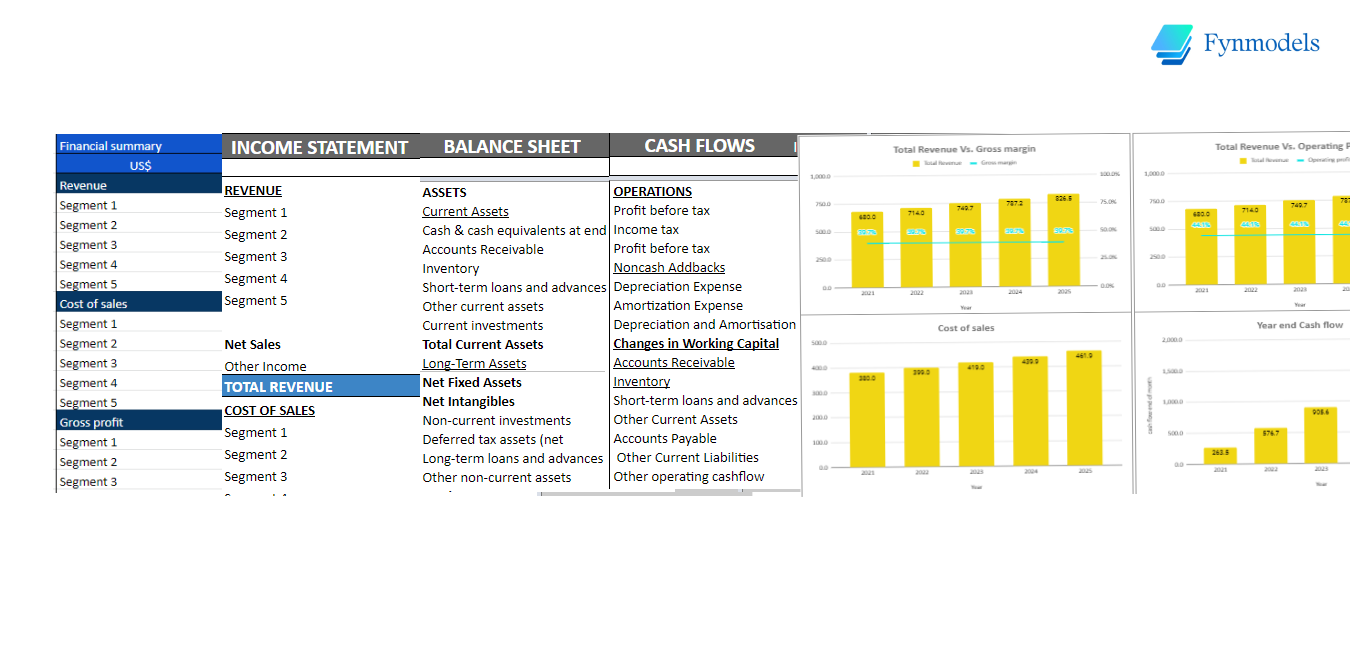

Business owners often find themselves questioning whether a new investment opportunity is worthwhile, whether their business is disproportionately focused on a particular activity which is hurting margins or when the business will be short of cash. All these paralyzing decisions are best enabled by the three financial statements i.e. balance sheet, the income statement and the cash flow statement respectively. These give an overall assessment of your business activities from a financial perspective and are included in the Standard Model.

Furthermore, the Common Size statement and Group Analysis sheets provide a comprehensive overview on the financial health of your business.

Estimate Cost of doing Business

The model has sheets for calculating Operating Expenditures (Opex) i.e. the cost of running business which is inclusive of admin overheads, sales and marketing expenses, tech expenses and so on. Another sheet for Capital expenditures (Capex) for tangible assets such as equipment, building, machinery, etc. and intangible assets such as software or patents. It also includes a sheet for calculation and maintenance of payroll data.

A separate sheet for capital financing is also included in the model. It includes short-term and long-term debt financing as well as equity financing.

Get Business Insight Dashboards

KPI dashboards help you spot trends and troubles quickly in your business. You can access key performance indicators (KPIs) with just a glance, giving instant insight into how the company is performing. Dashboard offers prebuilt summaries that provide valuable data at a quick glance without having to navigate through long lists of reports or graphs for each individual metric--saving time when there's important information right before us!

How to use Fynmodels

Fynmodels gives you the power to forecast your company’s topline and bottomline. Gain clarity on expected profitability, use it to create dashboards, identify key drivers of profit, establish annual budgets forecast forecasts and more!. Take a look at the quick introductory video on how you can save time and get to actions faster!

Frequently Asked Questions

If you are looking for more answers on how you can use Fynmodels portal and the models, please read below.

First add the Standard Model to your cart and then browse through the Category models listed in Products section. After purchase, once you add the Category model Sheet to Standard Model, you are good to build a Financial Model for your business.

Go to the Product menu and look for Financial models listed against your required Category. The Product page will give details about what the Category model comprises including a gist of the Revenue and Cost drivers, as well as key Category metrics and Dashboard. The Category model can be upgraded by purchasing Standard Model that includes Pre-built structure of financial statements and Supporting Schedules. Then you simply link the revenue and cost driver numbers into the Standard Model.

Upon receiving the download link, you will be prompted to save a MS-Excel version of the Model. The model comprises an Instructions Sheet which would be self-explanatory and also explaining the flow of data from input to data visualization. A Category Business metrics Sheet and Dashboard are provided which automatically responds to Model Inputs.

You need to link the Revenue and Cost of Sales/ Cost of Service summary table from Category Model into Profit and Lost statement of Standard Model. Follow the Comments within the Sheets to do this.

We recommend using MS-Excel.

It usually takes less than an hour to go through all of the sheets, and once you have the basic information, it takes much less time to adjust the inputs to create a set of forecasts that makes sense for your business. In Category Models, generally, growth rates corresponding to different Revenue and Cost of Sales/ Service drivers need to be input by the User. In some instances, Gross margin percentages might need to be input. Once all necessary inputs are made, the Model responds to the inputs and reflects in the KPI Dashboards.

Fynmodels has tested for model sanctity in the form that is offered to you. Depending on your skills in financial modeling, you are free to customize them yourself. However, impact to Standard and Category Models due to such edits will rest with the user and not Fynmodels.

If and when the Models require any fundamental change, we will be incorporating updates to the model. You will then be notified by email to download and use latest version free of charge.

The model is a simple Do-it-Yourself model. It is designed in such a way that anyone can drive it based on detailed instructions provided by us. If you require Modeling-as-a-Service (customization), we are happy to engage with you on a Project-basis and help you design the model accordingly.

Yes, we create custom models. Click on 'Contact us' for us to reach out to you.

Yes. On a case-to-case basis we offer Customization of existing models. Please contact us for more information.

Not at this moment. However, we do have plans to do so and once decide to initiate such workshops, you will be notified.

Sorry. There are no refunds.

Yes. We use Payment gateways that are secure. Read our Privacy Policies and Terms and Conditions for more details.